all casinos accepting cryptocurrencies

All casinos accepting cryptocurrencies

The world of finance is undergoing a digital revolution. For a number of years now banks have looked at ways to use digitization to streamline processes, enhance efficiency, and improve customer experience, with varying degrees of success lucky tiger casino review. However, the future of payments is venturing beyond just digitizing banking processes; it is about digitizing money itself.

By 2025, we can anticipate further advancements in mobile payment technology. One potential development is the wider adoption of biometric payments, where transactions are authenticated using fingerprints, facial recognition, or even voice recognition. This would streamline the payment process even further, making it more secure and user-friendly. Businesses should invest in mobile payment capabilities and stay updated on the latest technological trends to remain competitive. Consumers should also stay informed about new features and security measures in mobile payment solutions to make the most of this convenient payment method.

Card networks have delivered scale, security and interoperability, but the reality is that merchants bear high costs, and consumers are incentivized with rewards to keep using the same credit-based rails. It’s created a payments environment that is harder to evolve.

Do all cryptocurrencies use blockchain

Using blockchain in this way would make votes nearly impossible to tamper with. The blockchain protocol would also maintain transparency in the electoral process, reducing the personnel needed to conduct an election and providing officials with nearly instant results. This would eliminate the need for recounts or any real concern that fraud might threaten the election.

Using blockchain in this way would make votes nearly impossible to tamper with. The blockchain protocol would also maintain transparency in the electoral process, reducing the personnel needed to conduct an election and providing officials with nearly instant results. This would eliminate the need for recounts or any real concern that fraud might threaten the election.

For example, exchanges have been hacked in the past, resulting in the loss of large amounts of cryptocurrency. While the hackers may have been anonymous—except for their wallet address—the crypto they extracted is easily traceable because the wallet addresses are stored on the blockchain.

Currently, tens of thousands of projects are looking to implement blockchains in various ways to help society other than just recording transactions—for example, as a way to vote securely in democratic elections.

Many in the crypto space have expressed concerns about government regulation of cryptocurrencies. Several jurisdictions are tightening control over certain types of crypto and other virtual currencies. However, no regulations have yet been introduced that focus on restricting blockchain uses and development, only certain products created using it.

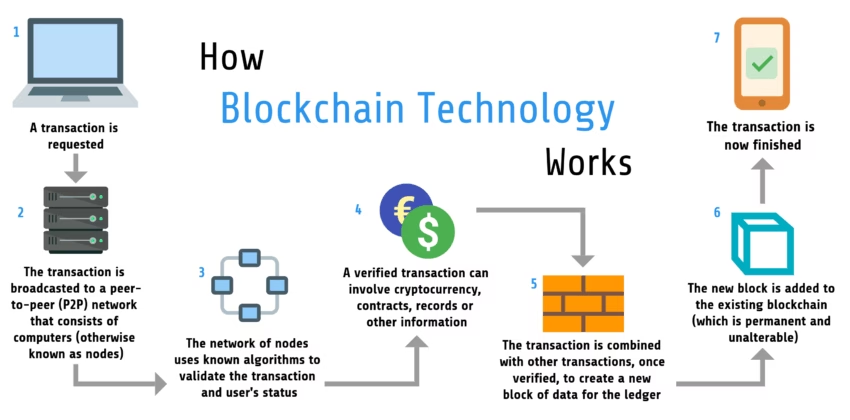

A blockchain allows the data in a database to be spread out among several network nodes—computers or devices running software for the blockchain—at various locations. This creates redundancy and maintains the fidelity of the data. For example, if someone tries to alter a record on one node, the other nodes would prevent it from happening by comparing block hashes. This way, no single node can alter information within the chain.

Value of all cryptocurrencies

Cryptocurrency market capitalization (market cap) refers to the total value of a particular cryptocurrency that is currently in circulation. It is calculated by multiplying the current market price of a cryptocurrency by the total number of coins or tokens that have been issued. The total market capitalization of all cryptocurrencies for today is $3,483,735,942,412

As with all currencies, the value depends on supply and demand. Bitcoin has value because there are high demand and low supply. Cryptocurrencies such as Bitcoin are available in limited amounts in the same way as precious metals such as Gold.

Almost. We have a process that we use to verify assets. Once verified, we create a coin description page like this. The world of crypto now contains many coins and tokens that we feel unable to verify. In those situations, our Dexscan product lists them automatically by taking on-chain data for newly created smart contracts. We do not cover every chain, but at the time of writing we track the top 70 crypto chains, which means that we list more than 97% of all tokens.

The first chain to launch smart contracts was Ethereum. A smart contract enables multiple scripts to engage with each other using clearly defined rules, to execute on tasks which can become a coded form of a contract. They have revolutionized the digital asset space because they have enabled decentralized exchanges, decentralized finance, ICOs, IDOs and much more. A huge proportion of the value created and stored in cryptocurrency is enabled by smart contracts.

Cryptocurrencies all

CoinMarketCap does not offer financial or investment advice about which cryptocurrency, token or asset does or does not make a good investment, nor do we offer advice about the timing of purchases or sales. We are strictly a data company. Please remember that the prices, yields and values of financial assets change. This means that any capital you may invest is at risk. We recommend seeking the advice of a professional investment advisor for guidance related to your personal circumstances.

Cryptocurrency prices are affected by a variety of factors, including market supply and demand, news, and government regulations. For example, news about developments in a cryptocurrency’s underlying technology can affect its price, as can news about government regulations. Also, the supply and demand of a particular cryptocurrency can affect its price. Finally, market sentiment and investor confidence in a particular cryptocurrency can also play a role in its price. We cover sentiment and technical analysis for example you can check top coins : Bitcoin, Ethereum, XRP, Cardano, Dogecoin.

Welcome to CoinMarketCap.com! This site was founded in May 2013 by Brandon Chez to provide up-to-date cryptocurrency prices, charts and data about the emerging cryptocurrency markets. Since then, the world of blockchain and cryptocurrency has grown exponentially and we are very proud to have grown with it. We take our data very seriously and we do not change our data to fit any narrative: we stand for accurately, timely and unbiased information.

Cryptocurrencies are digital assets that are secured by cryptography. They use decentralized networks to transfer and store value, and the transactions are recorded in a publicly distributed ledger known as the blockchain. Transactions are verified by network nodes and recorded in a public distributed ledger known as the blockchain. Cryptocurrency transactions are secure, and are verified by a decentralized network of computers.

The first chain to launch smart contracts was Ethereum. A smart contract enables multiple scripts to engage with each other using clearly defined rules, to execute on tasks which can become a coded form of a contract. They have revolutionized the digital asset space because they have enabled decentralized exchanges, decentralized finance, ICOs, IDOs and much more. A huge proportion of the value created and stored in cryptocurrency is enabled by smart contracts.

About the author